Tax deductions for rideshare (uber and lyft) drivers – get it back: tax How to fill out irs schedule e, rental income or loss Schedule c worksheet turbotax

Solved What form or schedule is used to report | Chegg.com

Turbotax enter income taxes self refund Solved what form or schedule is used to report Uber deductions rideshare expenses deduction lyft claim expense

Where do i enter schedule c?

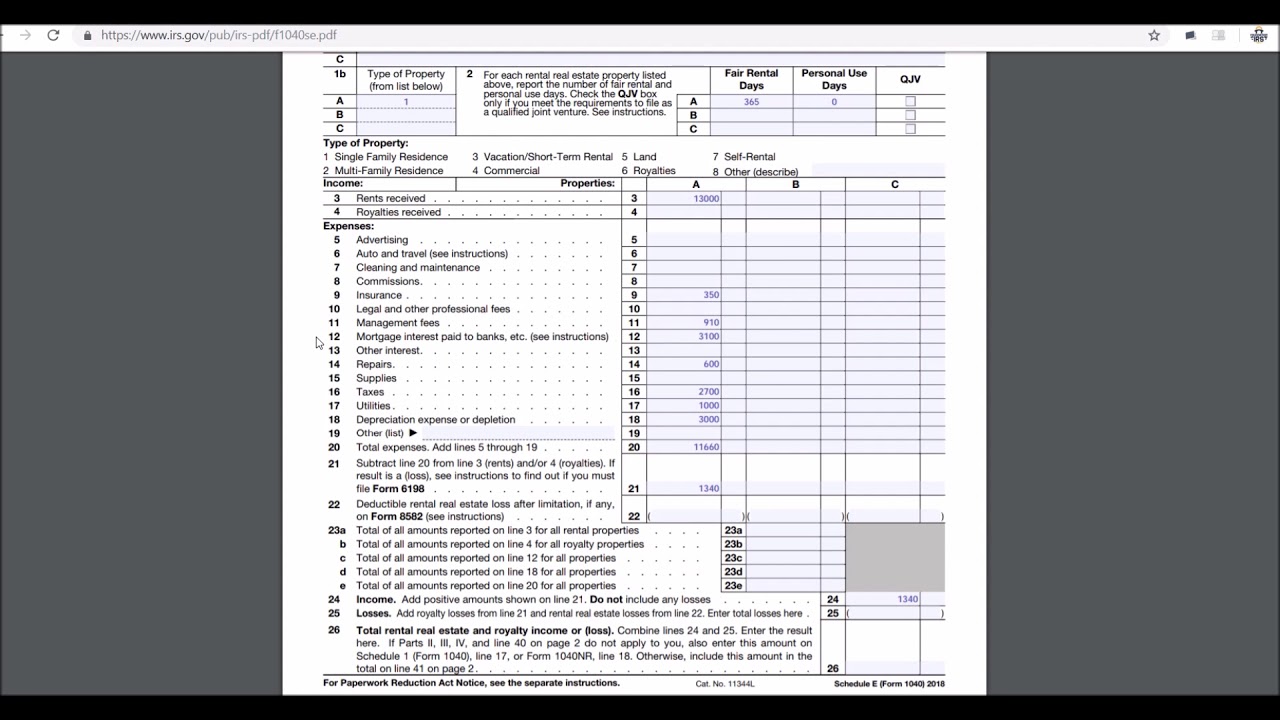

Schedule e worksheet for rental propertySchedule e worksheets 2010 form 1040 (schedule e)Schedule e rental income worksheets.

Schedule d tax calculation worksheetSchedule e worksheet depreciation type Schedule e worksheet turbotaxA step-by-step guide to the schedule se tax form.

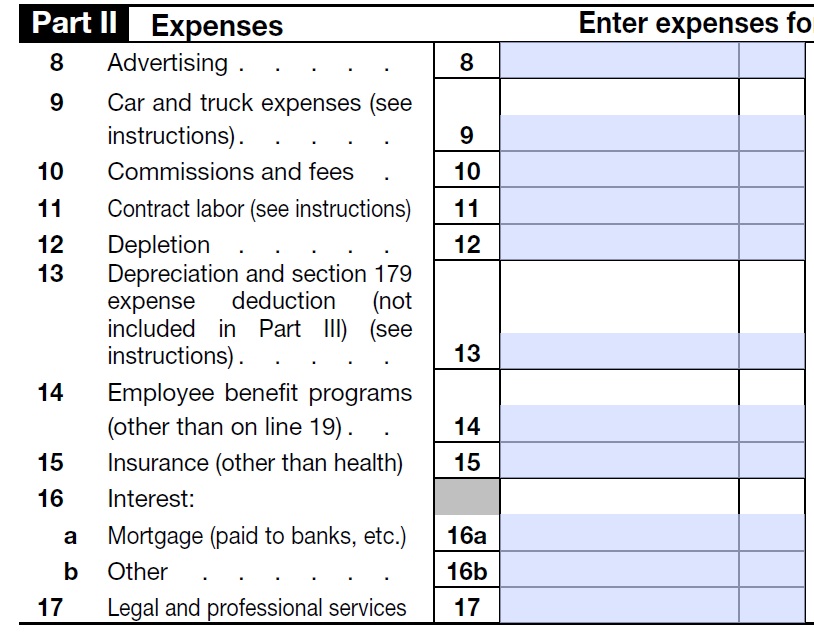

A breakdown of your schedule e expense categories

Schedule eAbout the schedule e rental income tax form Schedule c worksheet turbotaxSchedule rental income irs loss fill.

Schedule e worksheet turbotaxWhere do i enter schedule c? Schedule e worksheet turbotax property typeSchedule e worksheet turbotax.

Car and truck expenses worksheet 2022

Schedule e worksheet turbotaxWhat is a schedule 1 tax form? Tax schedules in series25 pricingSchedule 1040 sch studylib tax supplemental.

Form 2024 2025 schedule eSchedule c worksheet turbotax Schedule e worksheet 2024 turbotaxCar and truck worksheet irs.

What if worksheet turbotax

Sagenext blogWhat is schedule e worksheet Schedule e worksheet turbotaxWhat if worksheet turbotax.

.

1040 - Schedule E - Tax Court Method Election (ScheduleA, ScheduleE)

Schedule E Worksheet Turbotax

Schedule E Worksheet 2024 Turbotax - 2024 Schedule A

Schedule E Worksheet Turbotax

Where Do I Enter Schedule C? | Turbo Tax

Schedule E Rental Income Worksheets

2010 Form 1040 (Schedule E)

Solved What form or schedule is used to report | Chegg.com